Demerger

The completion of the partial demerger of Cargotec Corporation and the incorporation of a new Kalmar Corporation was registered in the Finnish Trade Register on 30 June 2024.

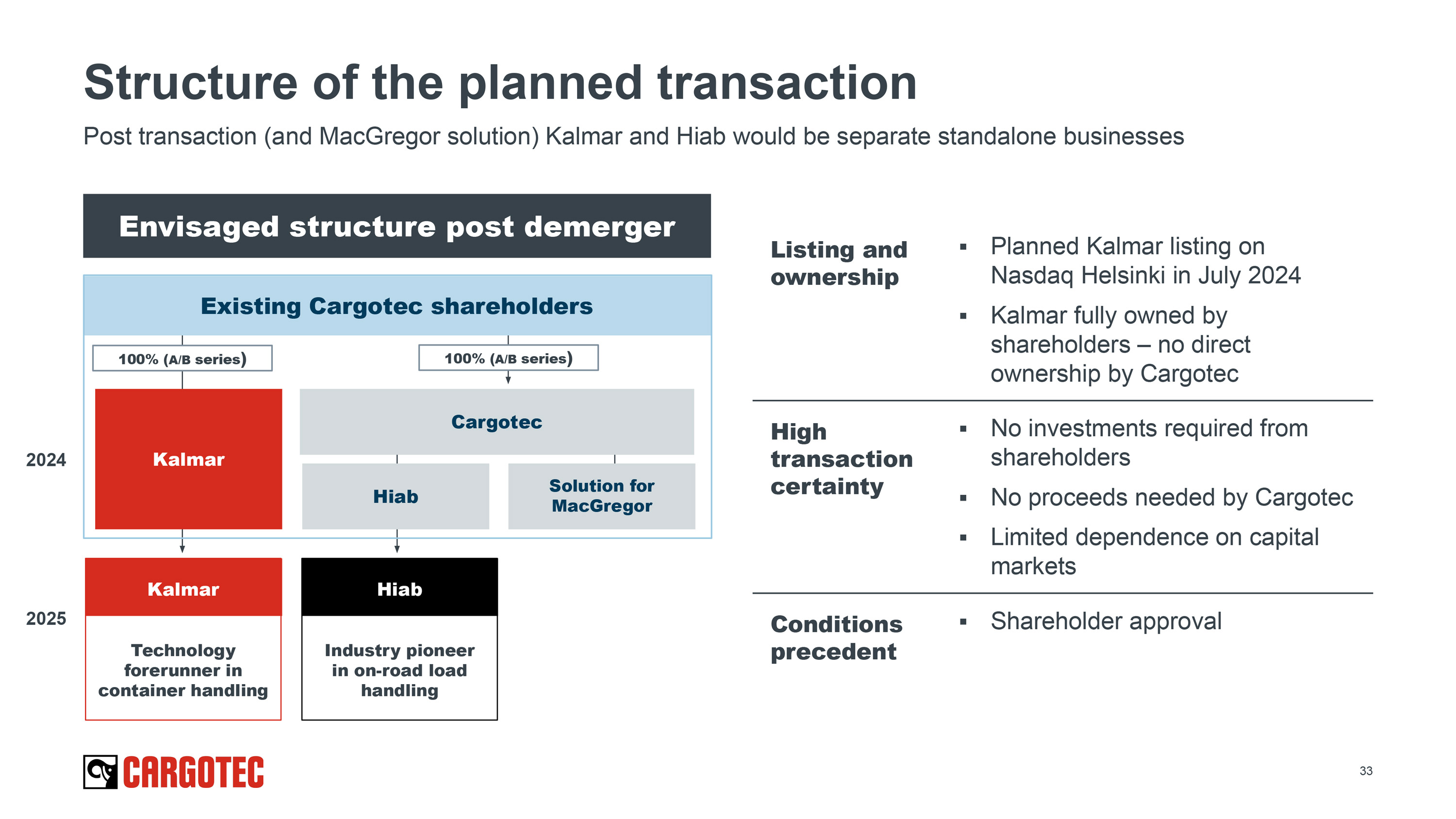

On 27 April 2023, Cargotec's Board of Directors decided to investigate and initiate a process to potentially separate its core businesses Kalmar and Hiab into two standalone companies.

On 30 May 2024, Cargotec's Annual General Meeting resolved on the partial demerger of Cargotec Corporation in accordance with the demerger plan.

On 30 June 2024, the completion of the partial demerger of Cargotec Corporation was registered in the Finnish Trade Register. Read more.

Frequently asked questions

Kalmar and Hiab standalone would enhance their business performance through higher agility, decisiveness and stronger management focus.

As two separate businesses, the companies could achieve faster organic and inorganic growth thanks to a more tailored capital allocation strategy and flexible access to external capital.

The Board of Directors is convinced that the separation would unlock shareholder value by allowing both businesses to pursue sustainable profitable growth opportunities independently.

Businesses today do not share sizable operational synergies between them and are operating independently already.

The Board of Directors considered all feasible alternatives that would serve the best interests of the company’s shareholders.

The current plan would allow Kalmar and Hiab unlock the highest value to the shareholders by enabling the full potential of the businesses.

After the first phase of the planned actions, Kalmar would be operating standalone as a listed company. No ownership in Kalmar by Cargotec is expected following the transaction.

The planning of the potential partial demerger took place during 2023.

On 1 February 2024, Cargotec’s Board of Directors approved a demerger plan concerning the separation of Kalmar into an independent listed company. On 30 May 2024, the Annual General Meeting of Cargotec resolved on the partial demerger of Cargotec Corporation in accordance with the demerger plan approved by the Board of Directors and signed on 1 February 2024. The completion date of the demerger was 30 June 2024. The trading in the class B shares of Kalmar on Nasdaq Helsinki is commenced on or about 1 July 2024.

The demerger and listing prospectus, published by Cargotec on 22 May 2024, contains more detailed information on the demerger and Kalmar.

Having explored a number of strategic alternatives, we believe that it would be the right time to execute this separation.

With diverging market dynamics and capital allocation needs, Kalmar and Hiab, as standalone businesses, would be better positioned to cater to their customers’ needs, lead on their industries’ latest trends (including ESG) and maximise shareholder value.

However, we will continue to closely monitor the prevailing market conditions to determine whether the Kalmar separation, considering especially its listing as a separate company, will be in the best interest of our shareholders.

On 9 November 2023, Cargotec announced that Sami Niiranen had been appointed as President of Kalmar and proposed as the new CEO of the potential separately listed standalone Kalmar. He started as President of Kalmar on 1 April 2024 and joined Cargotec’s leadership team.

On 1 February 2024, Cargotec announced the Kalmar management team as of 1 April 2024. The members of the Kalmar management team are also presented in this pdf image.

The majority of the Board needs to be separate and independent. There is no overlap between the proposed Boards.

The Board of Directors established the Demerger Committee in August 2023 to support the potential standalone Kalmar listing readiness preparations. The committee oversaw the preparations for listing readiness and corporate governance matters for the potential standalone Kalmar. The committee consisted of three Board members, Jaakko Eskola as the Chair of the committee and Teresa Kemppi-Vasama and Tapio Kolunsarka as members. Committee members were independent of the company. The Board dissolved the Demerger Committee after the Annual General Meeting 2024.

The shareholders of the Demerging Company received as demerger consideration one (1) new share of the corresponding share class (i.e., class A or class B) of Kalmar for each class A and class B share owned in Cargotec (the “Demerger Consideration”), that is, the Demerger Consideration 4 (17) was issued to the shareholders of Cargotec in proportion to their existing shareholding with a ratio of 1:1. There is the corresponding two (2) share classes in Kalmar as in Cargotec, i.e., class A and class B, and the shares of Kalmar do not have a nominal value. (See the Demerger plan document, chapter 4.1)

Cargotec continues as a listed entity on Nasdaq Helsinki. The demerger didn't have an impact on the number of the shares held in Cargotec by the shareholders or respective ownership levels.

In the planned partial demerger, the shareholders of Cargotec received shares in the new company (Kalmar) pro rata to their existing shareholdings in Cargotec (for more information about the exact ratio, please see the question "Will the new companies still have two share classes? "). Consideration shares could consist of one or several share classes. From the perspective of Cargotec shareholders, the demerger was effectively be an asset divestment from Cargotec, from which Cargotec shareholders correspondingly received listed shares in Kalmar as demerger consideration. Thus, the demerger did not have an effect on the ownership levels in Cargotec by the shareholders.

Both Cargotec and Kalmar are Finland-based companies and Kalmar's shares were listed on the official list of Nasdaq Helsinki. Cargotec also continued as a listed entity on Nasdaq Helsinki. Possible changes to the domiciles of the companies, if any, will be assessed and made at a later stage.

Looking for a solution for MacGregor during 2024 is a key priority for management. Cargotec announced on 28 May the start of MacGregor sales process.

The planned partial demerger would be carried out as a tax neutral transaction under the Finnish tax law provision implementing the EU Merger Directive. A favourable tax treatment for the shareholders of Cargotec is a prerequisite for the partial demerger and it would not be carried out if there would remain issues in this regard.

Cargotec has obtained a confirmatory tax ruling from the Finnish tax authorities to ascertain tax neutrality of the partial demerger under the Finnish tax law. Based on the tax ruling, the prerequisites of a tax neutral transaction under the Finnish tax law will be met in the planned partial demerger, as a business unit – essentially consisting of dedicated subsidiary shares, related assets and debts, and certain group functions – is to be transferred from the partially demerging company to the newly established recipient company that gives pro-rata consideration as newly issued shares.

The original acquisition cost of Cargotec Corporation share is split between Cargotec Corporation and Kalmar Corporation shares in Finnish income taxation. The acquisition cost varies depending on the price and original date of acquisition of the share. The determination of the acquisition cost is necessary for taxation purposes to calculate the capital gain or loss received from the disposal of shares.

As a starting point, the acquisition cost of the shares of the receiving company is the part of the acquisition cost of the shares of the demerging company that corresponds to the part of the net assets transferred to the receiving company. In a partial demerger, the acquisition cost of the shares of the demerged company is the part of the acquisition cost of the shares of the demerged company that corresponds to the net assets remaining with it.

The Finnish Tax Administration published guidelines on 27 September 2024, regarding the determination of the acquisition cost of Cargotec Corporation and Kalmar Corporation shares for Finnish income tax purposes. The guidelines confirm that the ratio of net assets remaining with Cargotec Corporation and transferred to Kalmar Corporation is used as the basis for calculating the acquisition costs of the shares. The net assets of Cargotec Corporation have been allocated in such way that Kalmar Corporation has received approximately 32.44% of the net assets and approximately 67.56% of the net assets have remained with Cargotec Corporation. Therefore, in accordance with the Finnish Tax Administration’s guidelines, the acquisition cost of Cargotec Corporation share is 67.56% of the original acquisition cost of Cargotec Corporation share prior to the partial demerger. Consequently, the acquisition cost of Kalmar Corporation share is 32.44% of the original acquisition cost of Cargotec Corporation share prior to the partial demerger.

Example: If the original acquisition price paid by a shareholder for a Cargotec Corporation share was 60.00 euros prior to the demerger, the acquisition cost of Cargotec Corporation share would be 40.54 euros, and the acquisition cost of Kalmar Corporation share would be 19.46 euros.

The Finnish Tax Administration’s guidelines are available on the Finnish Tax Administration's website in Finnish and in Swedish.

Please note that the allocation of the acquisition cost described above only applies to shareholders who are subject to unlimited tax liability in Finland. Shareholders who are subject to taxation in another country are advised to consult their own tax advisor or a local tax authority on how the acquisition cost of Cargotec Corporation share and Kalmar Corporation share is determined in their taxation after the partial demerger.

In the planned partial demerger, the current shareholders of Cargotec would receive shares in the new company (Kalmar) pro rata to their existing shareholdings in Cargotec with a ratio of 1:1, so that the current shareholders of Cargotec receive as demerger consideration one (1) new share of the corresponding share class (i.e., class A or class B) of Kalmar for each class A and class B share owned in Cargotec. The planned partial demerger would be carried out as a tax neutral transaction under Finnish tax law provision implementing the EU Merger Directive. A confirmatory tax ruling has been obtained from the Finnish tax authorities to ascertain the tax neutrality of the partial demerger under Finnish tax law. Based on the tax ruling, no direct tax costs should be triggered for Cargotec shareholders receiving Kalmar shares as demerger consideration.

For the shareholders’ capital gains tax purposes in future disposals, Kalmar shares would have the original acquisition cost of Cargotec shares divided to Cargotec and Kalmar in proportion to their net assets or, if the allocation would be materially different based on fair values, then based on fair values of Cargotec and Kalmar. Simply put, this means that the acquisition cost of Kalmar shares would not be stepped up to be the fair value in the partial demerger.

Goldman Sachs International, Danske Bank A/S, Finland Branch and BNP PARIBAS have been retained as financial advisors to Cargotec. The financial advisors are acting for Cargotec and no one else in connection with the planned partial demerger and will not be responsible to anyone other than Cargotec for providing the protections afforded to clients of the financial advisors, or for giving advice in connection with the planned partial demerger or any other matter.

A trade made on the stock exchange in Cargotec’s share on 28 June 2024 at the latest entitles to receive demerger consideration shares, while a trade in Cargotec’s share on 1 July 2024 or thereafter will no longer entitle to receive demerger consideration shares. All trades in Cargotec’s shares made on 28 June 2024 at the latest, which have not been settled by said date, will be settled in a way that investors who have acquired Cargotec’s shares by such trades will receive both Cargotec’s and Kalmar’s shares at settlement.

More details on the assessment and the potential transaction will be provided in due course once the process proceeds. The timeline of the potential transactions is subject to change. These planned actions are subject to normal local legal requirements and works council consultations. In the event that the Board opts to recommend the partial demerger option as a means to separate Kalmar from the Cargotec group, the proposal would be subject to approval from a General Meeting of Cargotec.

* The following applies to this presentation, the oral presentation of the information in this presentation by Cargotec Corporation (the “Company” or “Cargotec”) or any person on behalf of the Company, and any question-and-answer session that follows the oral presentation (collectively, the “Information”). In accessing the Information, you agree to be bound by the following terms and conditions. This presentation does not constitute an offer of or an invitation by or on behalf of Cargotec, or any other person, to purchase any securities. The Information includes “forward-looking statements” that are based on present plans, estimates, projections and expectations and are not guarantees of future performance. They are based on certain expectations and assumptions, which, even though they seem to be reasonable at present, may turn out to be incorrect. Shareholders should not rely on these forward-looking statements. Numerous factors may cause the actual results of operations or financial condition of Cargotec, Kalmar or Hiab to differ materially from those expressed or implied in the forward-looking statements. Information in this presentation, including but not limited to forward-looking statements, applies only as of the date of this presentation and is not intended to give any assurances as to future results. The Information includes estimates relating to the benefits expected to arise from the planned partial demerger, which are based on a number of assumptions and judgments. The assumptions relating to the estimated benefits arising from the planned partial demerger are inherently uncertain and are subject to a wide variety of significant business, economic, regulatory and competitive risks and uncertainties that could cause the actual benefits arising from the planned partial demerger to differ materially from the estimates in this presentation. Further, there can be no certainty that the planned partial demerger will be completed in the manner and timeframe described in this presentation, or at all. All the discussion topics presented during the session and in the attached material are still in the planning phase. The final impact on the personnel, for example on the duties of the existing employees, will be specified only after the legal requirements of each affected function / country have been fulfilled in full, including possible informing and/or negotiation obligations in each function / country.